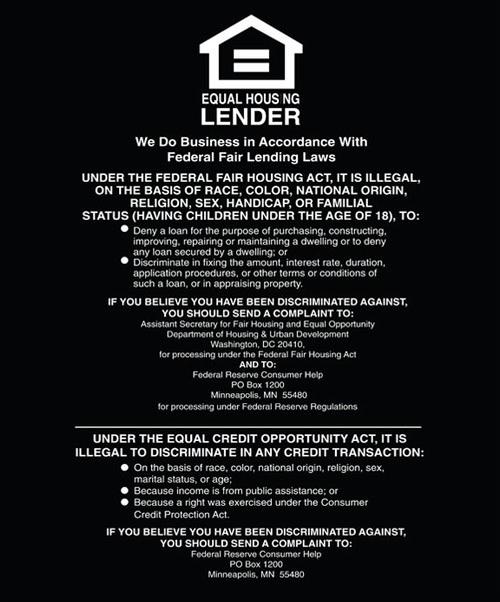

If needed, ask the lender whether help is available in your preferred language. You should take the time to make sure the credit product and terms work for you. Because a home equity loan is based on the value of your home, you may be able to qualify for much more funding. You shouldn’t ever feel pressured to sign. You have a right to receive information in writing - and in most cases, that means you get timely information on the decision a lender has made about your application for credit. Lenders shouldn’t make you feel rushed or unnecessarily delay action on your application. But make sure to ask them the following, more pointed questions to ensure that your timeline and needs are met. UNDER THE FEDERAL FAIR HOUSING ACT, IT IS ILLEGAL, ON THE BASIS OF. Ask about which fees and charges may be negotiable. A personal referral to a local lender who has a track record of being responsive and closing on time is hard to ignore. Under the Federal Fair Housing Act, it is illegal, on the basis of race, color, national origin, religion, sex, handicap, or familial status (having children. Be sure you understand your interest rates and the total amount of interest and fees paid over the long run. If needed, you can ask whether your credit report is available in your preferred language. This gives you a greater ability to monitor changes in your credit. When you visit the site, you may see steps to view more frequently updated reports online.

#Equal home lender free

You have the right to request one free copy of your credit reports each year, from each of the three biggest consumer credit reporting companies, by visiting. Be sure there are no mistakes or missing items in your credit reports. Applying is simple and can be completed 100 online anytime, from anywhere.

Our modern mortgage experience simplifies buying, so you can focus on living.

Learn about the benefits and risks of the loan or credit card you want. How it Works Loan Options Rates Calculators FAQs Get Pre-approved We’ve pressed fast forward on loan applications. In 1968, Congress enacted the Fair Housing Act, which made it illegal for lenders to discriminate on the basis of race, color, national origin, religion, sex or disability.

0 kommentar(er)

0 kommentar(er)